Whether you're creating a software, digital product, or good, building an audience for your product is critical. And in the pursuit of building this audience, companies can make the error of spending more resources acquiring customers than they get back from it.

When this happens, it's usually because customer acquisition cost – and its balance with customer lifetime value – has been overlooked. In this article, we're going to cover CAC in detail, explaining what it is, why it's important, and how you can optimize it to improve sales without expending your budget.

What is the customer acquisition cost?

Customer acquisition cost is exactly as it sounds: It's the price you pay to acquire a customer. In an ideal world, your product would be such a hot item that you'd be able to acquire paying customers for free.

The reality is, however, that acquiring customers is never free – you have to invest. That investment will primarily go to marketing, though customer support and research will usually need investment as well.

These investments total into a customer acquisition cost, or CAC. If you spend $5,000 and land 5 customers, then your CAC is $1,000 per customer.

Why is understanding customer acquisition cost so important?

1. Determine what marketing efforts are working

Without knowing what your customer acquisition cost is, you have little to no way to know if your marketing efforts are working.

When we say "working", we mean something slightly different from whether or not your marketing is landing conversions. That does factor in, but when it comes to CAC, it's just one piece of the puzzle.

With CAC in mind, your marketing efforts are only truly working if you're earning more from your customers than you're spending to acquire them.

For instance, if you have a marketing campaign that lands you 500 customers and each one has a $500 lifetime value, then that might seem like a pretty successful marketing campaign. However, if you spent $1,000 per customer, then it goes without saying that this campaign wasn’t so successful. In some cases, like high-growth, VC-backed companies, having a higher-than-LTV CAC can be justified, so long as there are clear plans in the future for generating new revenue streams with these customers.

If you aren't using CAC to evaluate your campaigns and are only looking at the number of customers you acquire through a campaign, then you're missing the mark. Or maybe you're hitting it dead-on. You don't know, because you've left out one of the most important pieces of data.

2. Optimize your LTV/CAC ratio

Another reason why customer acquisition cost is critical is that it can be used to optimize your LTV/CAC ratio. That's Lifetime Value over Customer Acquisition Cost.

A customer's LTV is the amount of revenue they provide you with over the span of being a customer. Like CAC, it's based on an average, as some customers will churn after a few months, while others are loyal for years.

Generally, the average customer subscribes to your service month after month, or upgrades annually, or buys from your product lineup periodically, and then eventually they churn.

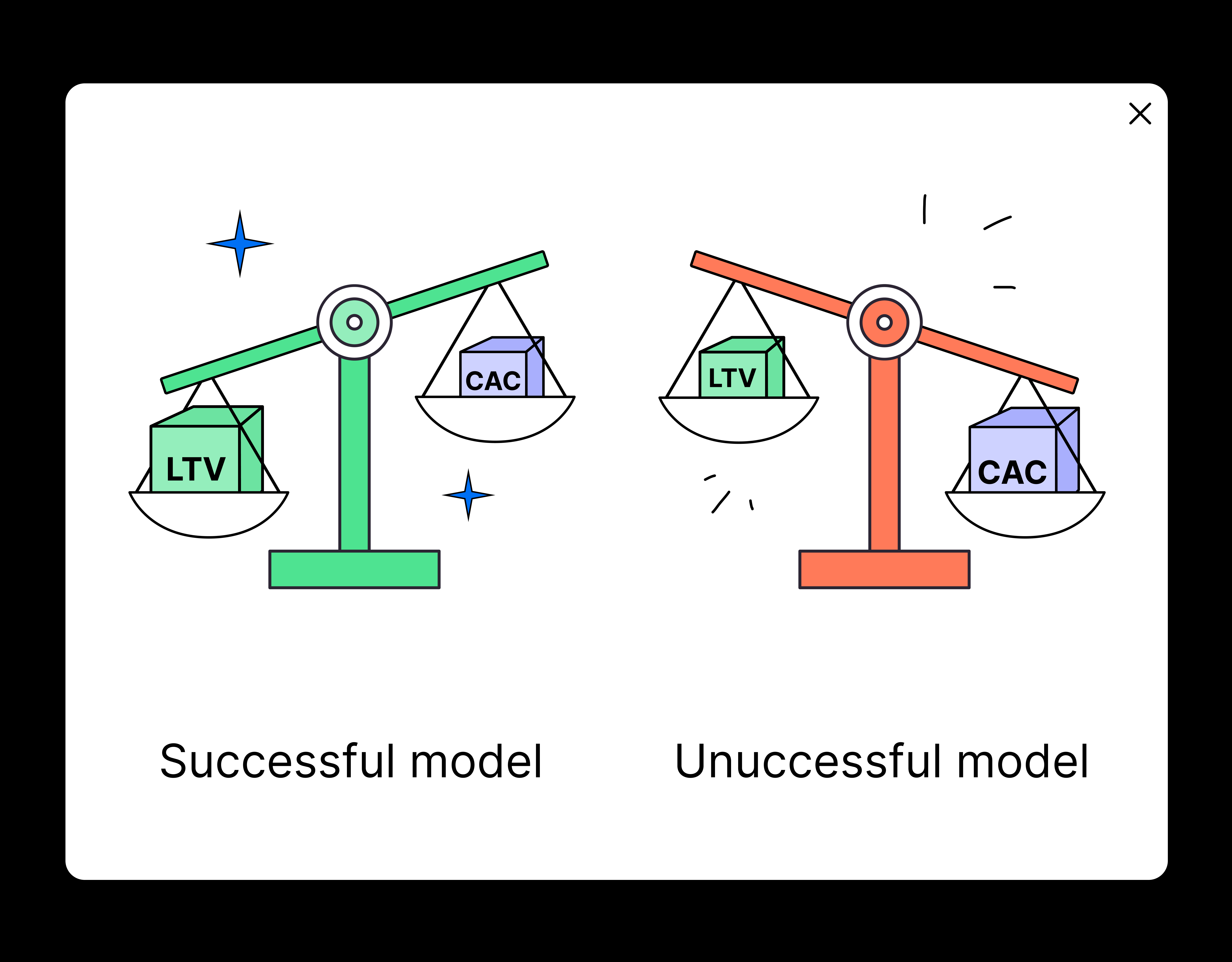

The amount of revenue they bring to your business between their first purchase and their last is their LTV. As with your marketing, you must be getting a return out of your CAC investment. Your LTV needs to be greater than your CAC a majority of the time, or else you're losing money. Knowing your CAC will help you monitor this.

Ideally, your LTV/CAC ratio should be 3 or higher. That means if you spend $100 acquiring a customer, you want them to spend at least $300 at your business before they churn.

3. Optimize your payback period

Thirdly, your customer acquisition cost can help you optimize your payback period. The payback period is the time it takes to earn back your CAC. It's similar to LTV in that it pertains to the revenue you receive from a customer. The difference, however, is that this is focusing on your break-even point rather than profit.

I know we just said that you want to aim for an LTV that triples your CAC. This is true, but before you worry about that, you want to be sure that you're going to break even. And you want to break even as soon as possible because until you break even, you're operating at a loss.

If you’re unsure what your CAC is, then you probably don't know what your payback period is. And that means that you could be operating at a loss without knowing it or knowing how severe the loss is.

How to calculate your customer acquisition cost

Calculating your customer acquisition cost is not too difficult. The formula is:

CAC = (Total amount spent on marketing and sales) / (Total customers acquired)

As mentioned earlier, if you spent $5,000 on a marketing campaign and acquired 5 customers as a result, then your CAC is $1,000.

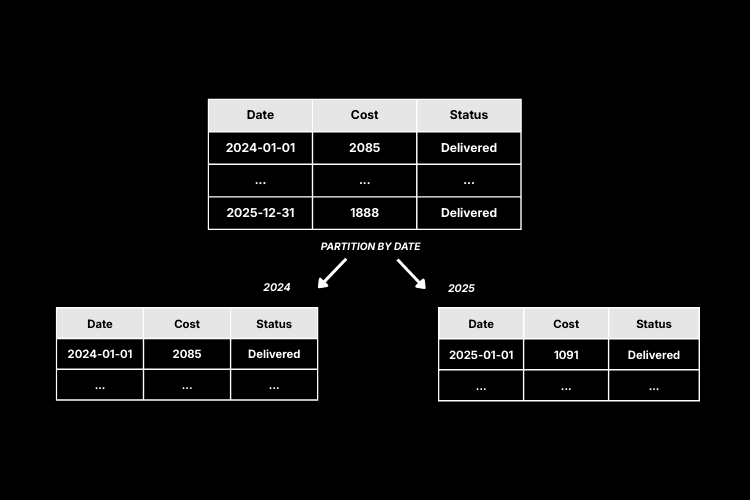

The real challenge in determining your CAC is knowing what to include in your total marketing and sales spending. It can be difficult to tie each customer to a specific marketing effort, especially if you are running concurrent marketing campaigns.

For that reason, looking at your quarterly spending and acquisitions can be the best way to go about this. Unless you can pin each customer to a specific marketing and sales effort, in which case that would provide you with a more accurate CAC.

Fixing your LTV/CAC ratio is key

Optimize your sales and marketing funnel

One of the key ways that you can fix your LTV/CAC ratio is to optimize your sales and marketing funnel. If you're spending too much on marketing per customer, then the issue is one of two factors (if not both):

- Your marketing campaign isn't effective at landing customers

- Your marketing campaign is working as you intended, but your LTV isn't high enough to support this specific campaign

In either case, you want to course correct with your marketing team. Either trim your marketing campaign or choose a more affordable alternative, or if it's simply not landing customers, change your whole approach.

Optimize your pricing strategy

The next factor you want to consider when fixing your customer acquisition cost ratio is rethinking your pricing strategy. If you've reworked (or can't rework) your marketing funnel and your LTV/CAC ratio still isn't right, then you might need to be charging more.

That might mean valuing your product higher, switching to a subscription model, implementing certain fees and services (like installations or training), etc.

Kill ads that aren't working and pour resources into those that are

This one's pretty straightforward – analyze your marketing efforts. See what channels are performing well and which aren't. If you don't have the data to differentiate between channels, then try lowering/raising the budget for various channels to gauge the impact each one is having on your conversions.

From there, you know what to do. If it isn't landing customers, then get rid of it!

Shorten your sales cycle

Lastly, take efforts to shorten your sales cycle. The longer your marketing funnel is, the longer it's going to take to reach your payback period and fulfill each customer's LTV.

There is, generally speaking, a floor to how short your sales cycle can be before it starts underperforming. Experiment with steady interactions until you find that floor.

Where can you use your customer acquisition cost?

Your customer acquisition cost can be visualized in dashboards and reports. It should be a key indicator at stakeholder meetings and is one of your most important tools for improving upon your strategy.

Weld can help you utilize and activate your CAC via our data experts and solutions like Weld Activate, which integrates with your company's favorite SaaS products. Reach out today to learn more.